Range trading systems make the best candidates for high frequency systems. They are less execution sensitive than trending systems for a simple reason. Range trades "catch the falling knife," making them suitable for using limit orders.

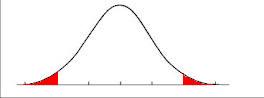

High frequency prices vary from the normal M30 and H1 charts. The lower the time frame, the better that the chart fits to a normal bell curve. One common theme in systems trading since the 2008 crash has been "tail risk" or "fat tails", which refer to the edges of a probability distribution like the bell curve. The fatter the tails, the more likely that a range trading system is to crash and burn.

The bell curve shows the tail risk of important events. The tails are colored in red. Fat tails mean that important news happens more frequently

The real world events captured in the tails reflect headline news like Bernanke speaking or Ireland announcing another referendum on all this bailout nonsense. The events only happen once, obviously. If you consider the news events in the context of hourly charts, they happen frequently as a percentage of the overall period. If you look at a one minute chart, that same event is now about 1/60th as important. Dropping down to tick charts nearly makes the events disappear in the statistical profile.

My experience is that the news cycle drives trends on a macro basis. "Macro basis" and high frequency are two topics that don't belong together. Trending systems should focus on long term trading, while ranging systems are far more suited to high frequency. If your system trend trades, you can throw it in the rubbish bin for high frequency trading ideas.

High frequency considerations

Keep in mind that there are effectively two ways to participate in the forex market: you can either act as a price taker or as a price marker. Price takers range across all market participants. A hedge fund or university endowment is just as likely to take a price as they are to make one. CTAs and retail forex traders are much more likely to make their decisions based on the expected market direction. Timing is critical for them, so they don't want to leave it to chance whether or not they'll get to enter a trade.

The trader gets filled right away. That's the major advantage. The main disadvantage to acting as a price taker is that you pay the spread every single time that you want to enter a position.

I sat with AvaFX in Dublin on my last trip. They charge a 3 pip fixed cost spread. I mentioned my concern about how that spread affects my client's EA performance. His MetaTrader expert advisor trades 4 times per day on 2 currency pairs. If you do the math on a 3 pip spread, it works out to 8 * 260 = 2,080 trades per year. If you're paying 3 pips and trading a $10,00 account, you would have to earn $6,240 per year - a 62.4% return, just to cover trading costs. I don't care how good a system is - it will never cover those kinds of costs. Trading on margin will not do anything to resolve the issue. Spread costs are directly proportional to the amount traded, which impacts the profit. There is no way to trade and make money if the transaction costs are too high.

Designing an expert advisor is difficult enough, but it's even harder when you factor in the trading costs. Say, for example, that I develop a EA that wins 75% of the time with a payout of 0.5:1 before trading costs. When the EA wins, it earns $0.5. It loses $1 whenever a loss occurs. The profit is 75 wins * $0.5 = $37.5. The loss is 25 * $1 = $25. The expert advisor's profit factor is 37.5/25 = 1.5.

That should sound great. The problem occurs when the total commission outweighs the total expected profit. This example required 100 trades. Let's say that we were trading mini lots with an average win of 5 pips and the average loss of 10 pips. That puts the gross profit at $375 and the gross loss at $250. The return is $125 for the 100 trades, excpet that we must now subtract the $100 for trading costs. The total profit plummets to a measly $25.

If the expert advisor's expectations held true for something like a 10 pip take profit and 20 pip stop loss, the trader might be better off to change the exit points. The reason is that the profitability may actually improve. The goal would be to reduce the number of trading opportunities with an eye towards making them more profitable relative to the costs.

A better approach, in my opinion, would be to switch over to market making. Although you usually still pay to trade, the advantage to market making is that you earn the spread rather than paying it. The spread is overwhelmingly most traders biggest cost. Not paying it opens the possibility of applying the strategy where one normally could not afford it.

Market making only works if your forex broker allows you to post best bid/best offer and have the price reflected on the screen. Most brokers claim that they are ECNs. A real forex ECN allows you to post limit orders. Whenever that order represents the best bid or offer, the price and size of your order shows up on the screen. The only retail trader friendly brokers that I know of are Interactive Brokers and MB Trading.

I ran my NinjaTrader license at MB Trading last week to test the execution and order flow. The test only use traded a microlot (0.01) and posted best bid or best offer on the EURUSD. The orders remained valid for anywhere from 1-10 minutes. Despite the small trade size and lengthy time period as best bid/offer, the orders only filled 75% of the time. That meant that I caught 100% of the losers but only 56% of the potential winners. Not good, in spite of getting paid for the limit orders.

Interactive Brokers is the next test candidate. They have been around much longer and should have far more order flow. I'm hoping that the low fill rate that I experienced making a market at MB Trading will improve substantially when I shift the same strategy to Interactive Brokers.

I expect to find a few other changes as well. The spread that I earn should fall from around 0.9 pips on EURUSD to 0.5 pips, which is indicative of Interactive Brokers' improved pricing. I also will have to pay a 0.2 pip commission, which reduces the net credit from 1.0 pips at MB Trading (0.9 spread + 0.1 commission) to 0.3. Nonetheless, I expect the improved fill rate on winning trades to work more in my favor.

The thing that most people will hate is that you can only test a market making approach with live money. It's sufficient to backtest a strategy using market orders with a 0 spread assumption. The goal is to weed out the junk from diamonds in the rough. No method exists, however, to accurately determine whether or not a trade would have gotten filled with a limit order. The only way to find out is to test an idea with live money, then to compare the results to a backtest over the same period. If the live, high frequency performance is similar to a backtest, then you probably have a winning approach.

The real motivation here is to get as many opportunities as possible. Just like the casino does everything to help you pull the slot machine faster, the trader should look for as many favorable setups as possible. High frequency stands out in this area. The inherent advantages of a system are more likely to manifest more quickly. Assuming that you get a handle on the trading cost problem, the profit is often limited only by the number of trades that can be squeezed into a day.

Programming options at high frequency

MetaTrader 4 is not a good candidate unless you expect to post orders once per minute or slower. MetaTrader suffers from the Trade Context is Busy error. Running an expert advisor on more than a single instrument could cause orders to enter too slowly or not at all. MetaTrader is only an option with MB Trading. Interactive Brokers does not support MetaTrader.

NinjaTrader works great and offers a lot of the broker portability that comes with programming in MQL. Programming a high frequency strategy in NinjaTrader works at most human speeds (5 seconds or more). For the brokerages where NinjaTrader submits orders using the broker's API, I find a speed bump affect at work. NinjaTrader processes the orders lightning fast, but the broker API cannot handle the speed and starts to choke. If you want to test any frequency that's not ultra high frequency, I recommend programming in NinjaTrader.

The FIX Protocol is the best option for the institutional trader that cares about maximal performance and does not suffer from the usual budget constraints. FIX is a fancy way of controlling communications between a custom platform and the broker. It does not involve software, only rules. The FIX protocol allows the trader to write software 100% from scratch. The trades and orders can go out the door literally as fast the machine can process them. It's the advantage that comes with building everything from scratch.

The post Range Trade at High Frequency appeared first on Algorithmic and Mechanical Forex Strategies | OneStepRemoved.